Fca Aml Risk Assessment Template

The idea of money laundering is very important to be understood for those working in the monetary sector. It's a process by which dirty cash is transformed into clear money. The sources of the money in precise are legal and the cash is invested in a method that makes it appear to be clear cash and conceal the id of the prison a part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the new clients or sustaining present customers the responsibility of adopting sufficient measures lie on each one who is a part of the group. The identification of such ingredient in the beginning is simple to take care of as a substitute realizing and encountering such conditions in a while in the transaction stage. The central financial institution in any nation gives complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide enough security to the banks to deter such situations.

What is an AML Policy Template. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML.

Comprehensive And Heavily Supportive Fca Regulatory Compliance3 Support In 2020 Regulatory Supportive Regulatory Compliance

Examples of poor practice.

Fca aml risk assessment template. Laundering and terrorist financing risks. Common weaknesses in risk assessment 19 323. Examples of good practice.

This followed Deutsche Banks Final Notice in 2017 for AML failings relating to mirror trading. We provide a supplementing AML Risk Assessment Template as required by the HMRC. 12 This template only applies to advice on investments when using a platform.

The draft LSAG AML Guidance for the legal sector 2021 describes this high level risk assessment as the cornerstone of anti-money laundering compliance. PEP definition 16 312. Assessing AML risks is a mandatory requirement for those with obligations under the MLR17.

Common risk assessment methodology 18 322. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. It also covers many of the supervisory authority requirements for the FCA and HMRC.

Training and awareness 16 313. Technologies in Anti-Money Laundering AML compliance by PA Consulting Group PA on behalf of the considered by regulated Financial Conduct Authority in the UK FCA. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among.

This report represents the culmination of three months of research and over 40 interviews with regulated firms technology providers and other bodies. It is seen as a legal or regulatory necessity rather than a matter of true concern for the business. Due Diligence Policy Templates.

The Companys strategy to meet its AML obligations is to keep up-to-date risk assessment of the business of the Company thus developing effective and proportionate risk-based money laundering and fraud prevention processes. This risk assessment template is to be used in conjunction with Your Company Names hereinafter referred to as the Company Risk Management Procedures and Anti-Money Laundering Policy and has been designed as a tool for identifying assessing and managing the risks of money laundering and terrorist financing. The anti-money laundering self assessment tool is not a.

We have developed a set of questions about management responsibilities reports a risk-based approach training suspicious activities and identifying customers. Cover 100 of flood risk in Asia Pacific with RMS models and maps. Know Your Compliance Limited provides policy templates to over 4500 organisations across the UK in hundreds of different industries.

There is little evidence that AML is taken seriously by senior management. It also outlines your day-to-day. Examples of poor practice Reward structures take account of any failings related to AML compliance.

FCA risk assessment Template. FCGprovides practical assistance and information for firms of all sizes and across allFCA-supervised sectors on actions they can take to counter the risk that they might be used to further financial crime. Examples of good practice.

We have included a template for this document in 10_Due_Diligence_AML 96 AML Risk Assessment. Senior management take money laundering risk seriously and understand what the Money Laundering Regulations 2007 are trying to achieve. The risk-based approach means a focus on outputs.

Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. Risk assessment 18 321. However some aspects of the assessment relate solely to broader aspects of investment advice for example attitude to risk ATRThe template also addresses the direct impact of the platform for example any additional cost.

Its contents are drawn. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. AML policies and procedures examples of good and poor practice 17 32.

AML policies and procedures 15 311. Separately the Financial Action Task Force FATF published risk-based guidance for the securities. Decisions on accepting or maintaining high money laundering risk relationships are.

The Money Laundering Risk Assessment Template is included with our AML Policy Template MLRO form. The risk-based approach to anti-money laundering. The Company aims to maintain the highest industry standards in terms of regulatory and compliance requirements.

All businesses with obligations under the Money. The conclusion should include a short narrative in support of the conclusion. Not only does it demonstrate that you have been through the required analysis.

Our Anti Money Laundering Policy Template provides 36 pages of content to help firms comply with the Money Laundering Regulations MLR. This guide gives an overview of the risk-based approach and helps you to carry out a risk assessment of your business. National Risk Assessment of money laundering and terrorist financing assessed capital markets to be exposed to high risks of money laundering.

The FCA and HMRC require that businesses with money laundering obligations carry out company-wide risk assessments to assess all business areas and activities for risks and vulnerabilities associated with money laundering and terrorist financing. Keeping AML policies and procedures up to date to. A lack of commitment to AML risk management among senior management and key AML staff.

Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. Findings high risk customers and PEPs 15 31.

Ultimate Fca Wind Down Plan Template With Examples For Financial Firms 9 Sections To Be Compliant Psp Lab

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk

Ppt Kyc Anti Money Laundering Ca Ramesh Shetty Fca Disa Ica Cisa Usa Powerpoint Presentation Id 317809

Ultimate Fca Wind Down Plan Template With Examples For Financial Firms 9 Sections To Be Compliant Psp Lab

Https Www Fca Org Uk Publication Forms Claims Management New Authorisation Form Notes Draft Pdf

Ultimate Fca Wind Down Plan Template With Examples For Financial Firms 9 Sections To Be Compliant Psp Lab

Crypto Registration And Fca Guidance On Applying In 2021 How To Apply Fca Guidance

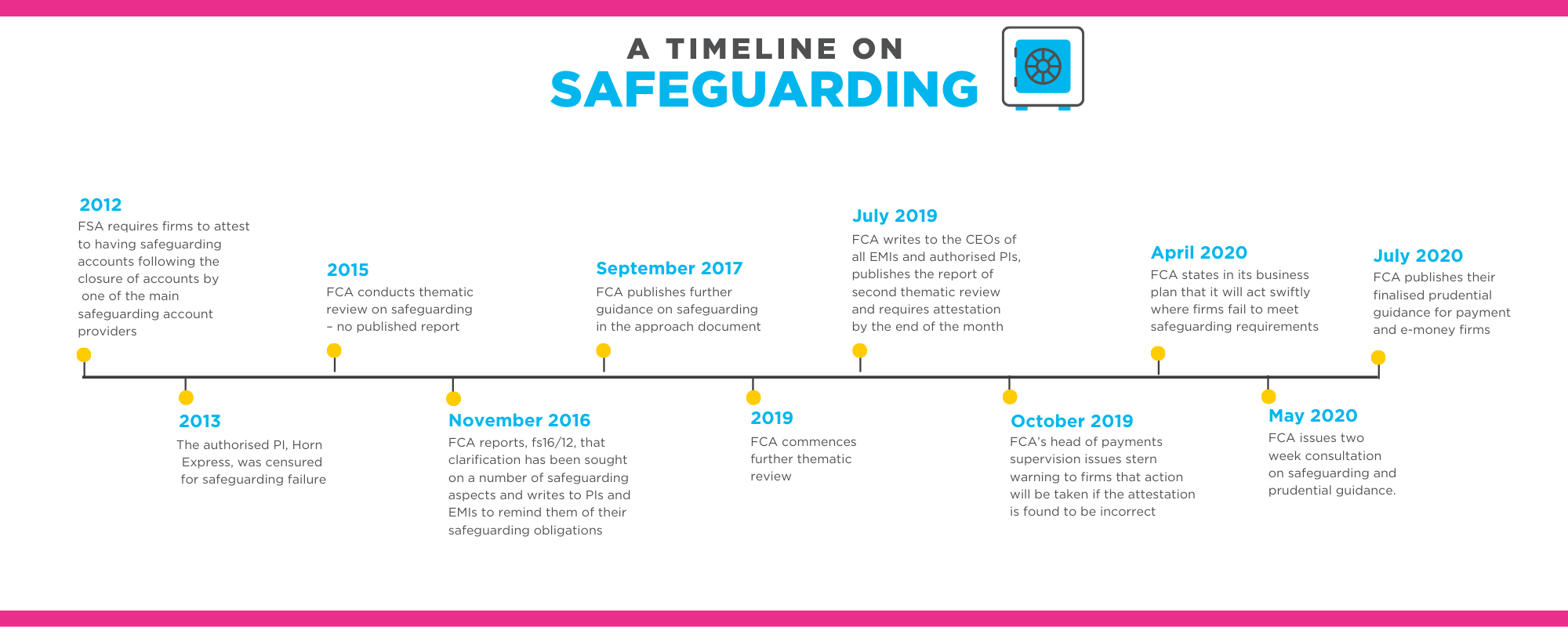

Fca Temporary Prudential Guidance For Payment And E Money Institutions

Fca Compliance Checklist Know Your Compliance

General Insurance Compliance Manual Template Fca Template Compliance Manual

Fca Template Compliance Guidelines Manual

Anexo 05 Process Planning And Audit V2 1 Reliability Engineering Systems Science

Fca Compliance Monitoring Plan Template For Fca Authorisations In 2021 How To Plan Compliance How To Apply

The world of rules can appear to be a bowl of alphabet soup at instances. US cash laundering rules aren't any exception. We now have compiled a list of the highest ten money laundering acronyms and their definitions. TMP Risk is consulting agency targeted on protecting monetary companies by lowering threat, fraud and losses. We now have huge financial institution expertise in operational and regulatory risk. We have a powerful background in program management, regulatory and operational danger as well as Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many hostile consequences to the group as a result of risks it presents. It will increase the probability of major dangers and the opportunity price of the bank and ultimately causes the bank to face losses.

Comments

Post a Comment