Fca Aml Enforcement Actions

The concept of cash laundering is very important to be understood for these working within the financial sector. It is a course of by which soiled cash is transformed into clean cash. The sources of the cash in actual are legal and the money is invested in a means that makes it seem like clear cash and conceal the identification of the criminal a part of the money earned.

While executing the financial transactions and establishing relationship with the brand new prospects or maintaining existing clients the responsibility of adopting adequate measures lie on each one who is a part of the organization. The identification of such factor to start with is simple to cope with instead realizing and encountering such situations in a while in the transaction stage. The central financial institution in any country offers complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present enough safety to the banks to deter such conditions.

The information will remain on this page for five years from the date of publication except for prohibition orders which are still in force after five years. Focus of FCA Enforcement Beyond changes to the FCA Enforcement process 201617 has been another busy year for the FCAs Enforcement team.

Taking enforcement action against firms that are found to have poor AML systems and controls has been one of the FCAs priority areas over the past few years.

Fca aml enforcement actions. We have fined the firm 873118. With the fallout from the Libor and FX scandals largely behind it the FCA has been refocussing its sights on other issues of importance to maintaining the integrity of the UK financial services industry. On June 17 2020 the FCA fined the London Branch of an international bank 37805400 for failing to put adequate anti-money laundering AML systems and controls in place between October 2012 and September 2017.

This page contains information about enforcement fines published during the calendar year ending 2021. Mark Steward Director of Enforcement and Market Oversight at the FCA said. The FCA fined the London Branch of an international bank.

The Anti-Money Laundering Act of 2020. Crucially amongst the FCAs key concerns where his failure to appropriately report concerns raised by internal auditors and the results of internal testing and instead he reassured the board and the banks senior management that AML systems and controls were working effectively. The supervisory authority known as the FCA currently.

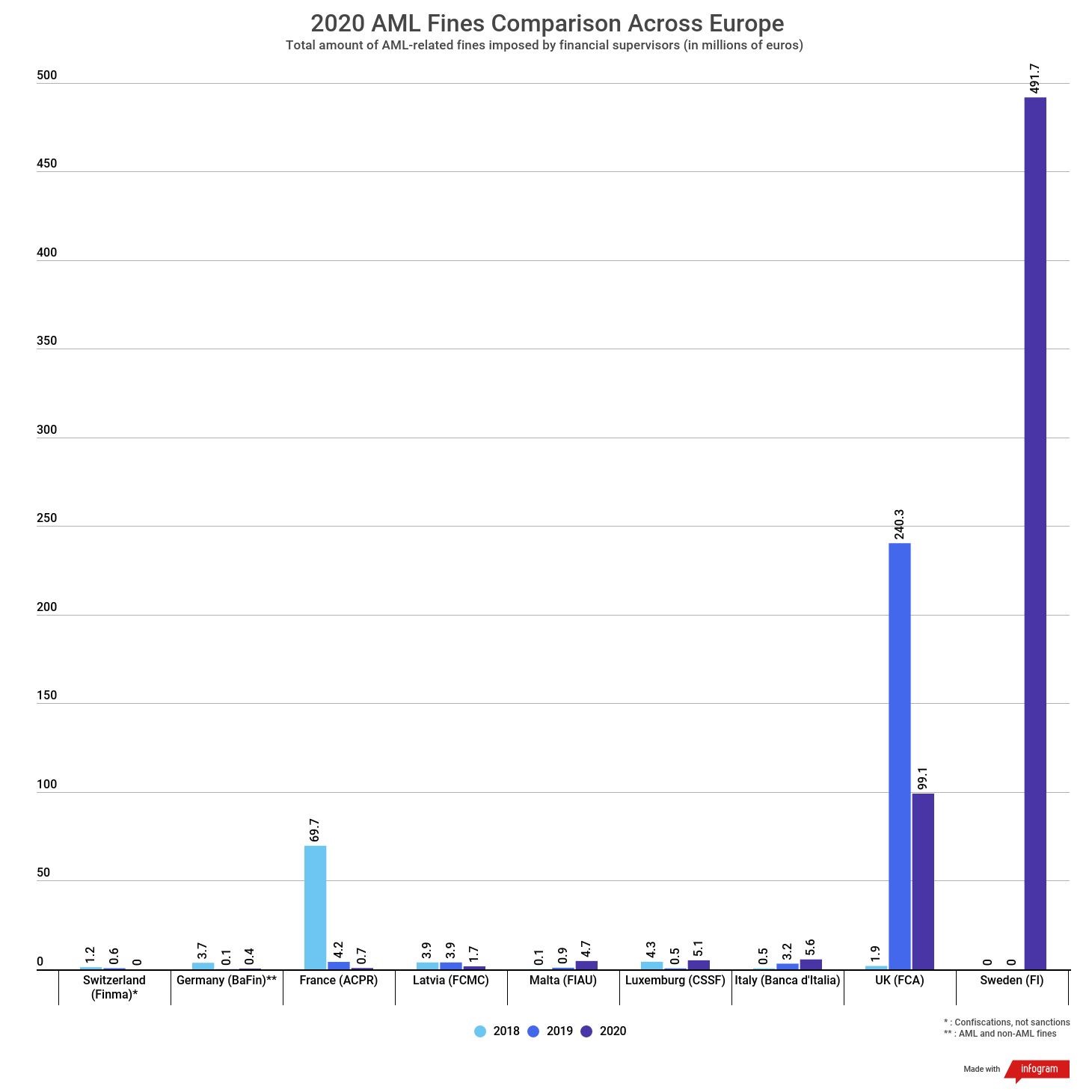

Other recent AML enforcement actions the FCA has taken under the civil regime include a 163 million fine in 2017 a 102 million fine in 2019 and most recently in June 2020 a 378 million fine all issued to global banks. Perkins Coie on 4132021. The Financial Conduct Authority will not shy away from criminally prosecuting individuals responsible for egregious anti-money laundering failures the head of enforcement at the agency said Thursday.

To me this enforcement action highlights that understanding the financial crime threat your firm faces and your own responsibilities remains critically important. On New Years Day 2021 Congress overrode a. A Survey of Key Provisions and Practice Takeaways.

The FCA has today fined Commerzbank AG London Branch 37805400 for failing to put adequate anti-money laundering AML systems and controls in place between October 2012 and September 2017. This Final Notice refers to breaches of PRIN 2 and PRIN 3 related to the risk of financial crime in the trading firms sector. The FCA recently fined the former CEO of Sonali Bank UK Limited 76400 for his part in the banks AML failings.

FCA to Weigh Use of Prosecutorial Powers in AML Cases. Enforcement Actions View the list of formal regulatory and enforcement actions taken by MAS for breaches of laws and regulations administered by MAS and related matters. The FCA has previously brought action against a number of firms for AML deficiencies and has stressed to the industry the importance of compliance with AML requirements.

The weaknesses in Standard Banks AML systems and controls resulted in an unacceptable risk of Standard Bank being used to launder the proceeds of crime. In this regard the Authority expects firms and its senior management to ensure that adequate AML policies and procedures are in place and are operating effectively. An FCA Enforcement investigation can be opened where there are grounds to suspect that serious misconduct has occurred.

The total amount of fines so far is 298800. Commerzbank London was aware of these weaknesses and failed to take reasonable and effective steps to fix them despite the FCA raising specific concerns about them in 2012 2015. In particular in the last two FCA Business Plans tackling financial crime has been listed as one of the FCAs seven key forward looking areas of focus.

We imposed a Fine. Major AML enforcement actions by US authorities in 2020 included a 150 million fine of Deutsche Bank for a lack of oversight in the Jeffrey Epstein scandal a 900 million fine for Israels Bank Hapoalim for tax evasion and money laundering a 60 million fine for Bitcoin mixer Helix. This is a low threshold and in recent years the FCA has emphasised its appetite to open more investigations and use them as a diagnostic tool that is to determine whether serious misconduct has occurred and not just to investigate in cases where the evidence is.

As a result they are required to maintain robust and risk-focused anti-money laundering AML systems. The bank itself was also subject to enforcement actions and a fine in relation to AML compliance failings. Enforcement Director05 Apr 2019.

The FCA expects regulated firms to promote a culture which supports these controls and which impresses on all members of staff the importance of complying with them. This Final Notice refers to Asia Research and Capital Managements failure to notify the FCA and disclose to the public its net short position in Premier Oil in breach of short selling disclosure rules. Risk-based AML systems and controls and to comply with the legal obligations of the Money Laundering Regulations 2007 the ML Regulations.

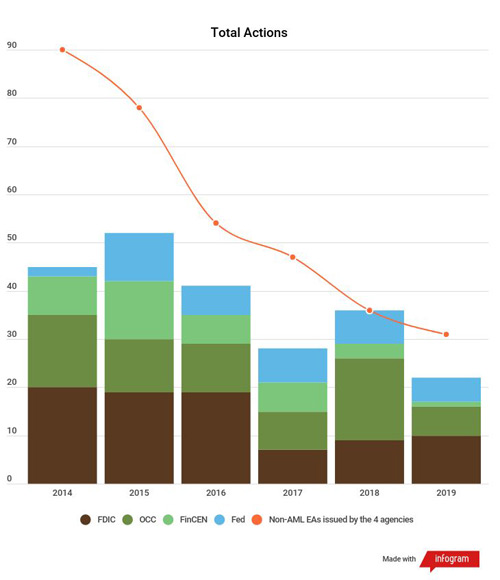

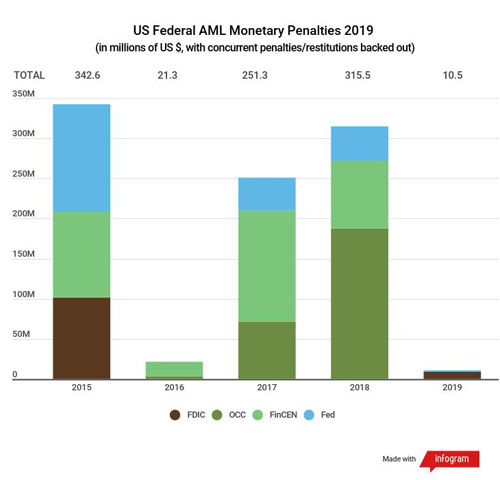

Key moments and takeaways from global AML fines and enforcement actions in 2020 include. This article summarizes three recent enforcement actions imposed by the FCA.

Record Breaking Fines On Banks For Kyc Aml Non Compliance

European Uk Aml Enforcement Remained Strong In 2020 Lexology

Moneylaundering Com Changes In Bank Regulations Financial Compliance Regulations Regulation Banks Money Laundering Cases Anti Money Laundering Money Laundering Training

تتر گلد ارز دیجیتال جدید کریپتویاب سامانه خرید و فروش بیت کوین Tether Gold How To Get Rich

Ethereum To Acquire Top Level Domain Name With New Partnership Cryptocurrency Korea Travel All About Time

Compounds Comp Token Takes Defi By Storm Now Has To Hold Top Spot All About Time Top Cryptocurrency Bitcoin

Icc Compendium Of Antitrust Damages Actions Icc International Chamber Of Commerce

Financial Conduct Authority Fca Aml Fines Sanction Scanner

Number Of Fca Fines Against Individuals Slumps Compliance Monitor

Moneylaundering Com Changes In Bank Regulations Financial Compliance Regulations Regulation Banks Money Laundering Cases Anti Money Laundering Money Laundering Training

The world of laws can look like a bowl of alphabet soup at times. US cash laundering laws are no exception. We've compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Danger is consulting agency focused on protecting monetary services by reducing risk, fraud and losses. We now have big financial institution expertise in operational and regulatory danger. We've a powerful background in program management, regulatory and operational risk as well as Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many antagonistic consequences to the group because of the risks it presents. It increases the likelihood of main risks and the opportunity price of the financial institution and finally causes the financial institution to face losses.

Comments

Post a Comment